Financial Literacy Games for College Students

Give your students a risk-free environment to practice and build their financial skills.

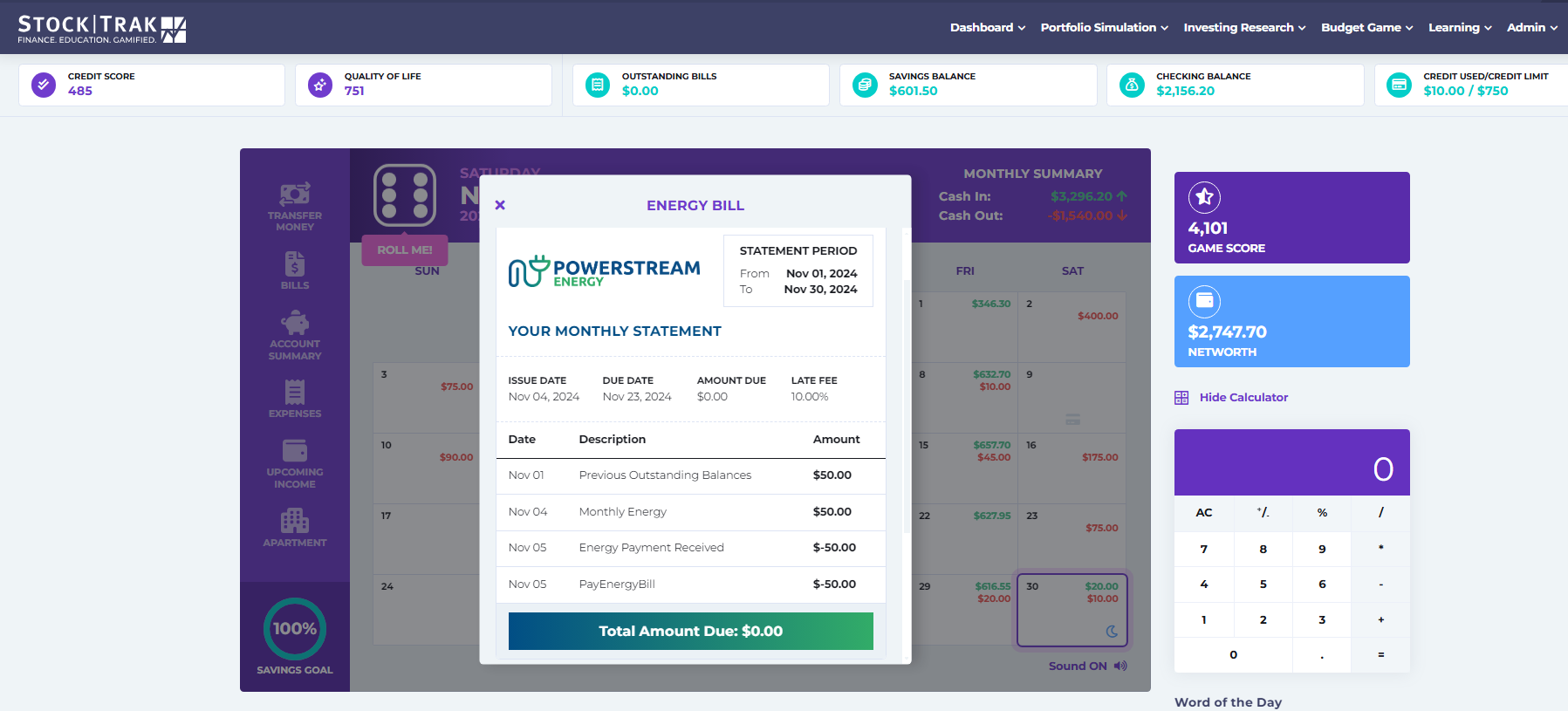

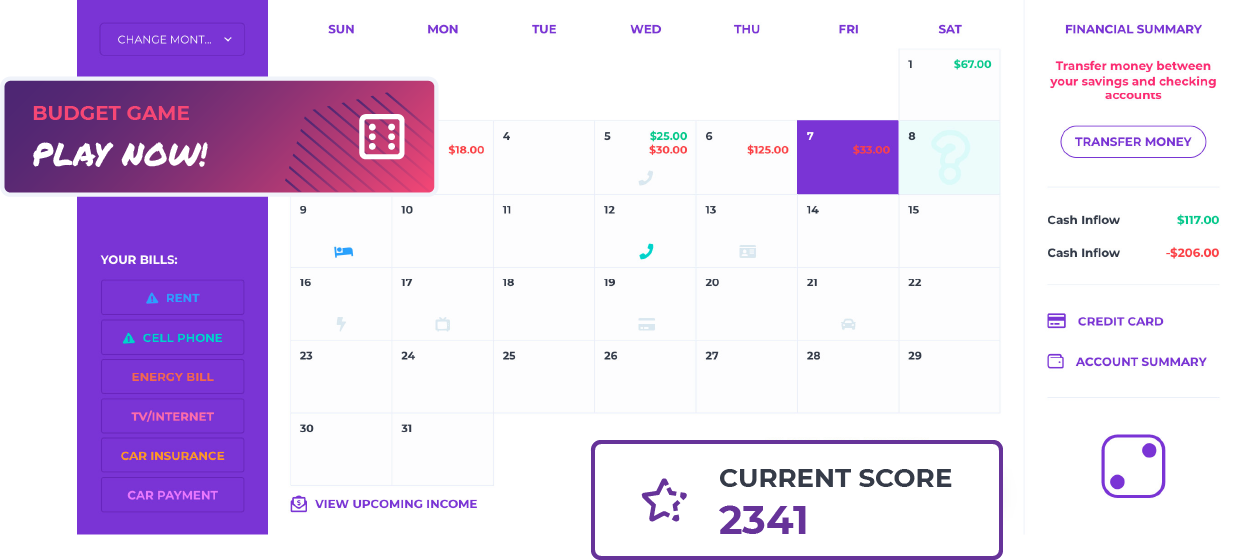

Personal Budgeting Game

Students practice managing a monthly budget of income, bills, and unexpected life events.

Investing Simulation

Students practice investing in Stocks, ETFs, Bonds, and Mutual Funds.

Turnkey, Standards-Based Curriculum

Access 300+ auto-graded lessons aligned with Jump$tart & CEE National Standards.

Request More Info Professor ResourcesA Unified Platform for Financial Literacy

From the basics of budgeting and cash management to credit scores and investment portfolios, our platform is designed to give university students the practical experience they need to navigate the real world with confidence.

If you are a Middle or High School teacher, please visit our High School Financial Literacy Site.

Preparing Students for Financial Independence

Whether you’re teaching Personal Finance, Intro to Business, or a First-Year Seminar, your goal is the same: to send capable, financially literate students out into the world.

Stock-Trak gives your students the practical experience and confidence they need to manage their own financial future. By managing a virtual budget, paying bills, and investing in the stock market simultaneously, students learn financial decision-making before they get their first full-time job.

This simulation benefits EVERY student, regardless of their major.

Request More InfoThe Financial Life Simulation forced me to become a better manager of my money and taught me how important it is to pay ALL of my bills on time.

Simulating Real-World Scenarios

We guide students through a realistic transition from college student to full-time employee, so they learn to adapt their budget to changing life circumstances. You control the cost of living, wage levels, and the types of unexpected events to match the focus of your program.

Phase 1: The Student Scenario (Part-Time)

- Income: Low, hourly wages from a part-time job plus bonuses from working extra shifts.

- Expenses: Shared rent with roommates, tuition, and daily life.

- The Lesson: Managing cash flow with limited resources and balancing their needs vs wants through interactive mini-games like Comparison Shopping and Time Management.

Phase 2: The Career Scenario (Full-Time)

- Income: Salaried position with a pay raise based on their previous academic performance.

- Expenses: Full rent (no roommates), student loan repayment, and health insurance premiums.

- The Lesson: Understanding the importance of “paying yourself first” despite higher bills and the long-term benefits of building an Emergency Fund.

Easy to Set-Up. Easy to Grade

Our platform automates the assessment process by tracking student performance across three key areas:

Financial Health

Students receive a score at the end of the Personal Budgeting Simulation based on their Net Worth, Credit Score, and Quality of Life—rewarding responsible financial habits.

Applied Skills

Assignment Engine verifies if students executed specific tasks, such as placing Limit Orders or diversifying into Mutual Funds and ETFs while using the Stock Market Simulation. You set the requirements; the system confirms the execution.

Standardized Curriculum

Select from over 300 self-grading lessons aligned with Jump$tart and CEE Standards. Whether you assign lessons on “Interest Rates,” “Buying a Car” or “Health Insurance,” the quiz scores feed directly into your gradebook.

With the ability to customize the content to match your curriculum and time frame, the options are unlimited!

Recommended Use Cases

Personal Finance faculty and First-Year Seminar directors use our platform because it teaches the concepts that spreadsheets miss. Whether you are teaching a dedicated Consumer Finance course or a broad Life Skills workshop, our game mechanics are designed to build lifelong habits.

Learn more about how these mechanics drive student engagement and view specific class examples.

Learn moreProven to Improve Financial Literacy

Stock-Trak is backed by decades of academic scrutiny. Research by Smith & Gibbs indicates that interactive simulations are particularly effective for students with diverse learning styles who may struggle to grasp complex financial concepts through static textbook definitions.

Peer-reviewed studies confirm that students who use our simulations show significantly higher retention of financial concepts compared to those taught via lectures alone.

View Academic Research

Campus-Wide Impact

Financial Literacy shouldn’t be limited to the Business School. The ONE skill every student needs before graduation is the ability to manage their own money.

We offer turnkey Site Licenses and branded portals for universities launching campus-wide initiatives. From First-Year Seminars to Student Life Workshops, Stock-Trak scales from a single class to 10,000 students.

Download BrochureMy students rated the Stock-Trak simulation as the highlight of the class. The various rankings kept ALL of my students motivated.

What Students and Professors are Saying

Based on 2025 Survey Results from Students and Faculty at participating Institutions.

Student Perspective

Significant Value

of students say Stock-Trak adds significant value to their class.

Increased Confidence

report increased confidence in their investing abilities.

Recommend Continuing

recommend their professor continue using Stock-Trak in future classes.

Stronger Job Candidate

believe Stock-Trak has made them a stronger job candidate.

Professor Perspective

Reliable & Robust

of faculty rated the platform as reliable and robust for class use.

Highly Educational

9 out of 10 professors rated Stock-Trak as highly educational.

Curriculum Value

of professors confirmed the platform adds significant value to their curriculum.

Business Schools

of the Top Business Schools use Stock-Trak.

Stock-Trak is the Gold Standard

Stock-Trak is the Gold Standard

in financial education for over 30 years.

over 30 years.

FAQ

Who Are We?

- The leading provider of financial literacy games and simulations for universities, high schools, corporates and the general public.

- Our various stock market and financial literacy simulations are used by over 20,000 professors/teachers worldwide and by over 100 corporations.

- 78% of the top 100 U.S. business schools used Stock-Trak in the last 2 years.

- For our Financial Literacy simulations, students learn to trade U.S. stocks, ETFs, bonds and mutual funds.

- Founded in 1990 with over 10,000,000 students served.

How Does It Work?

Students are given a scenario where they are working full-time and living on their own. They start with a virtual checking account with $1,000, as well as a savings account, credit card account and investment account with $10,000.

Students roll virtual dice to proceed through the weeks and learn to deposit their paychecks, pay all of their bills, start an emergency fund, learn to improve their credit score, and practice investing in the stock market. Meanwhile, life’s unexpected events keep happening that challenge their budgeting and cash management skills.

Student Accounts and Site License Pricing

We offer flexible pricing models for individual classes,

campus-wide programs, and high school dual-enrollment initiatives.

How Can We Help?

Schedule a live walkthrough, find answers to commonly asked questions, send us a specific question,

or learn more about your free professor account to see what’s included.