StockTrak is pleased to announce an exciting enhancement to our bond trading simulation: the addition of International Bonds to help students gain a truly global perspective on fixed-income markets.

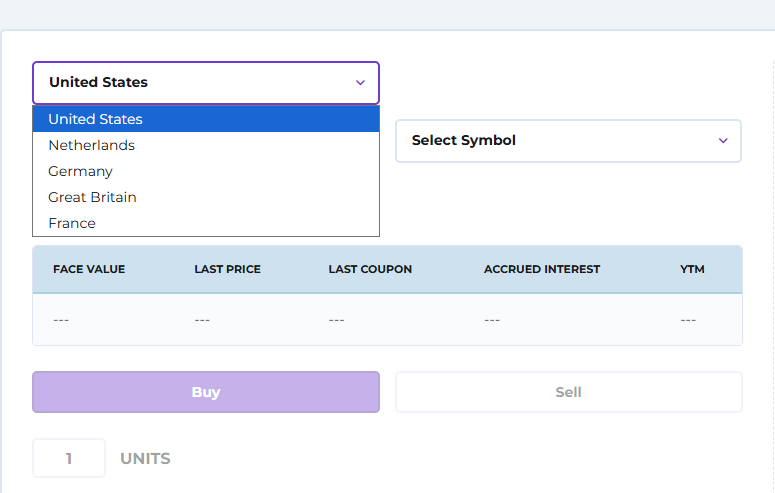

Previously, StockTrak allowed students to trade a diverse range of U.S. corporate and treasury bonds, depending on the parameters set by the course instructor. With this update, your students can now also trade a selection of corporate and government bonds from the United Kingdom, France, Germany, and the Netherlands. A new “Exchange” selector in the Bonds trading pit allows students to seamlessly switch between markets and explore the nuances of international fixed-income instruments.

As with stocks, professors have full control over which bond markets are available in their course. Bond exchange permissions follow the same settings as stock exchanges—so enabling French stock trading will also make French bonds available (if bonds are enabled in your class at all).

This enhancement opens the door for richer course projects, case studies, and experiential learning opportunities, allowing students to compare yields, evaluate currency risk, and analyze global interest rate environments.

We’re excited to see how this new feature helps your students expand their understanding of the interconnected global bond market.

-The StockTrak Team