How to Grade the Stock-Trak Project

From Intro to Advanced Investments classes and Personal Finance classes too. Choose the grading rubric that fits your curriculum.

Universal Grading Legend

Use this scale to translate the rubric achievements into numerical grades for your gradebook.

A+

Exemplary

The student exceeded all requirements, demonstrated deep analytical insight, and met performance bonuses.

A

Excellent

The student completed 100% of tasks with high accuracy and provided clear, thoughtful analysis.

B

Proficient

The student completed the majority of tasks (80-90%) but provided only basic summaries or missed minor details.

C

Satisfactory

The student met the minimum requirements (70%) but lacked depth in analysis or consistency in trading.

F

Insufficient

The student failed to complete a significant portion of the simulation or assignments.

Intro to Investments Class

Best For: Investments classes, Introduction to Finance or Financial Markets classes.

This approach ties the simulation directly to your syllabus. As you cover specific concepts in class (e.g., Bonds, Equities, Hedging), students are required to execute matching trades in their portfolio. You can toggle on/off different security types and trading strategies throughout your simulation.

How it Works

- Create a single Stock-Trak Assignment containing specific trade tasks (our recommended list is below).

- Require students to use the “Trade Notes” feature on every transaction to explain why they made the trade.

- At the end of the term, students submit a short summary explaining what they learned.

You can customize the number of trades your students need to earn their grade or choose other types of trades when setting up your class.

| Action | Required Trades | Completed |

|---|---|---|

| Trading – Buy or Sell Stocks/ETFs | 15 | No |

| Trading – Buy or Sell Mutual Funds | 5 | No |

| Trading – Buy or Sell Treasury Bonds | 5 | No |

| Trading – Buy or Sell Corporate Bonds | 5 | No |

| Trading – Use a Market Order | 10 | No |

| Trading – Use a Limit Order | 5 | No |

| Trading – Use a Stop Order | 5 | No |

| Theme | Lesson Titles | Time Estimation |

|---|---|---|

| Watch Video | Managing Your Portfolio | 15 mins |

| Using Order Terms | 2 mins | |

| Stocks | A Beginner’s Guide to Investing in Stocks | 7 mins |

| How to Read a Stock Quote like a Pro | 10 mins | |

| How to Trade Stocks? | 4 mins | |

| How to Research & Compare Stocks | 12 mins | |

| Bonds | How to Trade Bonds? | 2 mins |

| Getting Started with Bond Investing | 10 mins | |

| Mutual Funds & ETFs | The Pros and Cons of Mutual Funds | 15 mins |

| How to Trade Mutual Funds? | 2 mins | |

| A Simple Explanation of ETFs | 20 mins | |

| Advanced Concepts & Research | How to do Investing Research? | 8 mins |

| Why You Should Diversify Your Portfolio | 11 mins |

The Grade Breakdown

- 90% – Completion of Required Trade Tasks & Assigned Lessons/Tutorial Videos (verified by the Assignment Engine)

- 10% – Quality of Trade Notes & Final Reflection Paper

- +5 Extra Credit Points if the portfolio beats the S&P 500

Intro to Investments Grading Table

| Grade | Trade Requirements | Trade Notes & Reflection | Performance |

|---|---|---|---|

A+ |

100% Complete | Insightful Analysis Explicitly connects textbook theory (e.g. Beta, P/E) to price action. |

Exceeded Beat the S&P 500 |

A |

100% Complete | Clear Analysis Accurately identifies wins and losses with logical reasoning. |

N/A Did not beat S&P 500 |

B |

80-90% Complete | Basic Summary Lists trades made but lacks theoretical connection. |

N/A Did not beat S&P 500 |

C |

70-79% Complete | Weak Summary Minimal notes; acts as a trade log rather than an investing journal. |

N/A Did not beat S&P 500 |

F |

< 70% Complete | Missing No reflection submitted. |

N/A Did not beat S&P 500 |

Ready-to-Use Student Assessment

We prepared a Final Reflection activity sheet you can share with your students that guides them to move beyond simple summaries and apply course concepts (like Beta, P/E Ratios, and Yields) to their trading history.

View Intro to Investments Final ReflectionAdvanced Investments Class

Best For: Advanced Derivatives, Wealth Management or Portfolio Management classes.

This approach treats students like new hires on Wall Street managing their first High-Net-Worth client.Students are given a specific starting capital (configurable by you, from $100,000 to $100 Million) and a specific Client Profile. They are not trading for themselves; they are trading to meet the client’s goals.

How it Works

- You assign a standard Client Scenario (see example below).

- Students execute trades throughout the semester. Every trade must include a “Trade Note” justifying the decision.

- In the final report, students analyze their best and worst trades, explaining why they did them and what they learned.

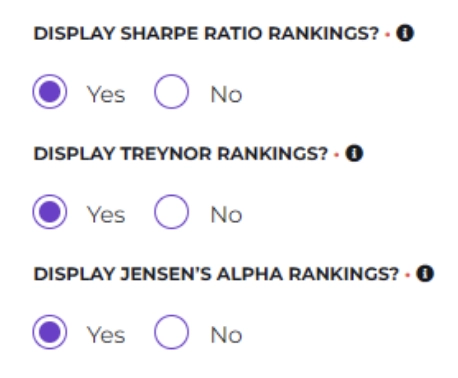

Instructor Setup Note: Enable Risk-Adjusted Performance Metrics

Stock-Trak provides built-in risk-adjusted performance metrics, including:

• Sharpe Ratio

• Treynor Ratio

• Jensen’s Alpha

To support quantitative performance analysis and benchmarking, you should enable these rankings during class setup.

Toggle these “on” while on the Portfolio Settings page when creating your class.

Example Scenario: The “Aggressive Growth” Client

- The Client: A 35-year-old software engineer with high disposable income.

- The Goal: Maximum capital appreciation.

- The Constraint: High risk tolerance, but the portfolio must maintain exposure to at least 3 distinct sectors (e.g., Tech, Emerging Markets, Green Energy).

You can customize the number of trades your students need to earn their grade or choose other types of trades when setting up your class.

| Action | Required Trades | Completed |

|---|---|---|

| Trading – Buy or Sell Stocks/ETFs | 25 | No |

| Trading – Buy or Sell Mutual Funds | 3 | No |

| Trading – Buy or Sell Treasury Bonds | 3 | No |

| Trading – Buy or Sell Corporate Bonds | 3 | No |

| Trading – Short a Stock or ETF | 5 | No |

| Trading – Use a Limit Order | 10 | No |

| Trading – Use a Stop Order | 10 | No |

| Trading – Buy a Call Option | 5 | No |

| Trading – Write a Call Option | 5 | No |

| Trading – Buy a Put Option | 5 | No |

| Trading – Write a Put Option | 3 | No |

| Trading – Buy or Sell Index Futures | 3 | No |

| Trading – Buy or Sell Interest Rate Futures | 2 | No |

| Theme | Lesson Titles | Time Estimation |

|---|---|---|

| Investing Strategy | How to Choose Stocks Strategically | 17 mins |

| How to Develop an Investing Strategy | 23 mins | |

| Margin & Short Selling | Margin & Short Selling Explained | 10 mins |

| Options & Derivatives | What are Options? | 8 mins |

| Watch Video – Trading Options | 3 mins | |

| Watch Video – Trading Futures | 4 mins |

The Grade Breakdown

- 70% – Stock-Trak Assignments Tasks & Videos (verified by the Assignment Engine).

- 20% – Analyst Report & Trade Notes.

- 10% – Performance (Meeting the Client Goal).

- +5 Extra Credit Points if the portfolio beats the S&P 500

Advanced Investments Grading Table

| Grade | Stock-Trak Requirements | Analyst Report & Notes | Performance |

|---|---|---|---|

A+ |

100% Complete | Professional Quality Justifies every trade against the client profile. Deep Alpha/Beta analysis. |

Exceeded Goal Beat the Benchmark |

A |

100% Complete | High Quality Clear notes and analysis. Adhered to client’s investing goal |

Met Goal Matched Benchmark |

B |

80-90% Complete | Adequate Summary of strategy provided, but lacks deep data support. |

N/A |

C |

70-79% Complete | Weak Missing trade justifications; Portfolio drifted from client mandate. |

N/A |

F |

< 70% Complete | Missing No report submitted. |

N/A |

Ready-to-Use Student Assessment

We’ve designed a final project that treats your students like professional portfolio managers. They must submit a formal report justifying their risk and returns to a mock “Investment Committee.”

View Advanced Investments Final ReflectionPersonal Finance Class

Best For: Personal Finance, Financial Literacy, and Intro to Business courses.

The goal of this rubric is to give students exposure to the financial markets and an understanding of key financial literacy concepts. It relies on the Stock-Trak Assignment Engine to auto-grade student effort across both the Budgeting and Investing simulations, as well as a comprehensive selection of self-grading financial literacy lessons.

How it Works

- Select the Personal Finance Service Level during class setup to enable both the Stock Game and Budget Game.

- Configure the Budget Game settings (wages, bills) to match your local standard of living.

- Students are graded on Completion: Did they finish the required number of virtual months (e.g., 12 or 18)?

- Students trade stocks, bonds, and mutual funds (or cryptos) to grow their savings (you can toggle asset classes on/off).

- Create a single Stock-Trak Assignment containing the specific trading tasks and lessons recommended below.

You can customize the number of trades your students need to earn their grade or choose other types of trades when setting up your class.

| Action | Required Trades | Completed |

|---|---|---|

| Trading – Buy or Sell Stocks/ETFs | 15 | No |

| Trading – Buy or Sell Mutual Funds | 5 | No |

| Trading – Buy or Sell Treasury Bonds | 2 | No |

| Trading – Buy or Sell Corporate Bonds | 2 | No |

| Trading – Use a Market Order | 5 | No |

| Trading – Use a Limit Order | 3 | No |

Stock-Trak’s Learning Center is designed to function as a “one-stop shop” for your entire course. We offer hundreds of self-grading lessons, videos, and mini-activities that are fully aligned with the Jump$tart/CEE National Standards for Personal Finance Education and the NBEA’s Personal Finance standards. Whether you are looking for a few supplementary tasks or a comprehensive curriculum replacement, you can mix and match these modules to fit your specific syllabus.

| Theme | Lesson Titles | Time Estimation |

|---|---|---|

| Budgeting, Saving, and Spending | Break Free From Money Stress with a Budget | 9 mins |

| What is Money? | 10 mins | |

| A Simple yet Powerful Way to Build Wealth | 9 mins | |

| Evaluating Big-Ticket Purchases | 10 mins | |

| The Car Buying Checklist | 23 mins | |

| Choosing the Best Banking Option for You | 16 mins | |

| Managing Credit | A Beginner’s Guide to Borrowing Wisely | 20 mins |

| Credit Cards: Terms, Fees, and Moreg | 17 mins | |

| How to Use Debt to Your Advantage | 5 mins | |

| What Your Credit Report Says About You | 17 mins | |

| Mortgage Options for First-Time Homebuyers | 18 mins | |

| Debt Snowball and Avalanche | 15 mins | |

| What Is Bankruptcy? | 9 mins | |

| Income and Taxes | What’s in Your Compensation Package? | 14 mins |

| What Benefits to Look for in a Job Offer | 13 mins | |

| Planning Your Career Path | 10 mins | |

| Tax Basics You Need to Know | 10 mins | |

| Income Tax Filing Tips & Tricks | 10 mins | |

| Get Practice Filing a Sample 1040 Tax Return | 10 mins | |

| Tax Credits & Deductions You Need to Know | 11 mins | |

| Risk and Financial Decision | How to Prepare for Unexpected Expenses | 7 mins |

| Protect Yourself as a Consumer | 8 mins | |

| The Secret to a Comfortable Retirement | 14 mins | |

| Types of Insurance | 10 mins | |

| What Damage Does Home Insurance Cover? | 9 mins | |

| Car Insurance: How to Lower Your Rates | 14 mins | |

| Why Health Insurance is So Expensive | 11 mins | |

| Investing | A Beginner’s Guide to Investing in Stocks | 7 mins |

| Why Investors Need to Use Ticker Symbols | 3 mins | |

| How to Read a Stock Quote like a Pro | 10 mins | |

| Why You Should Diversify Your Portfolio | 11 mins | |

| Watch Video – Managing Your Portfolio | 15 mins | |

| How to Trade Stocks? | 4 mins | |

| Watch Video – Using Order Terms | 2 mins |

The Grade Breakdown

- 50% – Budget Game Completion (Auto-graded).

Did the student complete the required number of virtual months? - 40% – Stock-Trak Assignment (Auto-graded).

Completion of the recommended Trading Tasks (e.g., Buy Stocks, Bonds) and Personal Finance & Investing Lessons. - 10% – Final Reflection

A summary explaining their budgeting strategy, what they learned from the simulations, and how this impacts their real-life financial plans. - +5 Extra Credit Points if the portfolio beats the S&P 500

Personal Finance Grading Table

| Grade | Budget Game | Stock-Trak Assignments | Final Reflection |

|---|---|---|---|

A+ |

100% Complete (e.g. 12/12 Months) |

100% Complete (All Trades & Lessons) |

Insightful reflection that connects simulations to real-life financial goals. |

A |

100% Complete | 100% Complete | Strong reflection that clearly articulates the top 3 lessons learned. |

B |

80-90% Complete (e.g. 10/12 Months) |

80-90% Complete | Submitted a basic summary of actions. |

C |

70% Complete (e.g. 8/12 Months) |

70% Complete | Weak explanation that lacks detail or personal insight. |

F |

< 6 Months | < 50% Complete | Missing the final reflection. |

Ready-to-Use Student Assessment

We have prepared a student activity sheet that guides students through the trade export process and provides the specific reflection questions for both the Budgeting Game and Stock Market Simulation. It is formatted and ready to add to your syllabus.

View Personal Finance Final Reflection